How Distracted Driving Can Affect Your Insurance

Distracted driving is quickly becoming the #1 cause of accidents, and the reasons why are obvious. As we’ve become more reliant on having everything at the tip of our fingers, we’ve become addicted to our phones and their ability to be able to answer calls, send messages, check-in with social media, and look for directions. Sometimes it’s just too easy to find the information when it is available at the click of a button. Distracted driving doesn’t just affect cell phone use. It includes being lost in thought, eating, paying too much attention to the passengers, or anything that distracts you from the important task of driving.

It’s something we are all guilty of. I consider myself to be an advocate against

distracted driving and with that in mind, one day slipped up and it almost hurt someone.

I heard a ding come from my cell phone, and was expecting an important message.

Trying to do the right thing, I thought I would get to the next stop sign and if there was

no one behind me, I would quickly check my messages. The next stop sign came up

and I was able to send a message back to my customer. While stopped, I had missed a

girl stepping off the sidewalk into the intersection. I was driving a pickup truck and didn’t

see the girl till I started to drive away, and her reaction in trying to avoid me was enough

that I could see her and stop. This event has made me more aware of the fact that it can

happen to anyone at any time. The point here is, that even when we are trying, we all

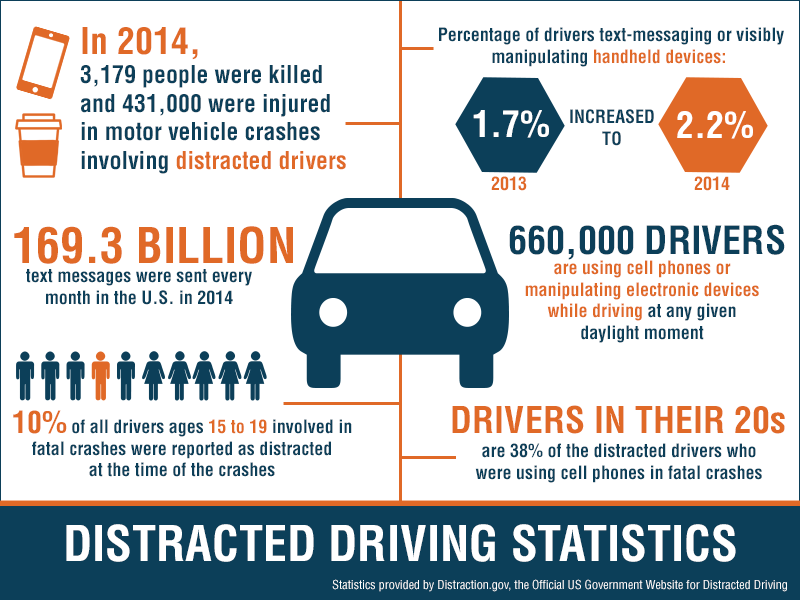

seem to have a story that we can relate to about distracted driving. Distracted driving statistics

paint a very clear picture that it is something that needs to be dealt with in our society.

Consider some of these facts:

● Distracted driving costs society $40 billion a year.

● An estimated 391,000 drivers were injured in distracted driving crashes in 2017.

● In 2019, distracted driving was a reported factor in 8.5% of fatal motor vehicle

crashes.

With these stats and others, insurance companies have started to make it clear that

they will take a no-tolerance approach to people caught distracted driving.

What Does This Mean To Your Insurance?

According to CBC News, the RCMP now has a longer lens that can track a distracted driver

from 1.2 km away. Over the Victoria Day long weekend officers were using these high-quality

lenses to catch distracted drivers across the country.

As of January 1, 2016, the penalty for distracted driving in Alberta is a $287 fine and three

demerit points, but that isn’t the only penalty that you may incur. A distracted driving ticket on

top of any fines you may incur will double your Insurance premiums in Alberta. In some

scenarios, insurance companies are denying Section C coverages, this means you may not

qualify for Collision or Comprehensive (Fire, Theft & Vandalism) on your car due to this ticket or

a combination of this and other moving violations. Only Third Party Liability (Sections A & B),

are the law in Canada, so Insurers do NOT have to offer Section C and they may also deny

payment options, you will be expected to pay your full premium in full.

Tips To Avoid Distracted Driving

The best tips to avoid distracted driving require careful planning. To avoid being distracted by a GPS device, you should plan your route in advance. If possible utilize voice activation or pull over to the side of the road safely and look over your route if you are confused. Similarly for a cellphone, utilize voice-activated dialling and or a Bluetooth headset to use your phone hands-free. If travelling with a passenger, assign a “designated texter” who can send and receive texts for you while you drive. If you need to contact emergency services while driving, there is no penalty for calling 911 while driving, though it is still a good practice to pull over if possible. Be careful if you have food or drink in the car and make sure your passengers don’t distract the driver while the vehicle is in motion. Set your playlist or station in advance, and if you need to stop, pull over to do so.

What Should I Do If I Get An Infraction

Talk to us. As an insurance broker, we represent you to the insurance companies to ensure you receive the best rates and coverage. We are here to help and will guide you through the process.